UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

CALIFORNIA RESOURCES CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all the appropriate box):

☒ | No fee required. |

|

|

|

|

|

|

|

|

|

|

|

|

☐ | Fee paid previously with preliminary materials. |

☐ |

|

|

|

|

|

|

|

|

|

“Low Carbon Intensity Fuel for Today and Net Zero Fuel for The Future” California resources corporation

“Low Carbon Intensity Fuel for Today and Net Zero Fuel for The Future” California resources corporation 20202022 proxy report and notice of annual meeting

California Resources Corporation

California Resources Corporation

Letter to Shareholders from the ChairmanChair of the Board

Dear Shareholders,

California Resources Corporation (“CRC”) celebrated its fifth anniversary in late 2019,I am proud of the progress and changes CRC made during 2021. With a strengthened balance sheet, strong low-decline low carbon intensity assets, dedicated employees and an experienced management team operating under the direction of the new Board of Directors, (the “Board”) applaudsCRC was able to demonstrate operational excellence and accomplish significant financial success.

I am honored to have helped guide the progress CRC has made in developing a stronger company through improved governance, consistent performance and a culture built on its entrepreneurial spirit. Our experienced management team has instilledCompany as the Company’s core values of Character, Responsibility and Commitment to drive performance. The Board plays an active role in fostering CRC’s governance policies, aligning compensation with performance and promoting the robustnessChair of CRC’s strategy amidst volatilityBoard of Directors. The separation between the CEO and Chair roles demonstrated CRC’s strong governance commitment while the addition of several new directors enhanced the diversity of perspectives and skill sets on our Board. In 2021, we brought on three new Board members which provided us with significant experience in commodity markets.renewables, carbon capture, environmental, social and governance (ESG), as well as sustainability reporting. CRC is committed to its ESG goals and the company’s current assets are well positioned to help California reach its energy transition goals. This year, the Board unanimously approved a 2045 Full-Scope Net Zero Goal. The value-driven approachCompany’s Sustainability Committee remains dedicated to supporting and guiding CRC down the path to reach this goal.

In 2022, CRC will not only remain dedicated to enhancing its sustainability initiatives but will also focus on maintaining its robust financial foundation through its base E&P business. The Company will continue to focus on core areas with strong margins that generate significant cash flow while continuing to emphasize cost reductions and operational excellence. These cash flow generating assets will continue to help fund additional shareholder friendly initiatives, as well as the advancement of CRC’s executive leadership continuesCarbon Management Business and solar projects.

We believe we have a strong mix of diversity and experience among our current Board members, and we are always looking for ways to enable us to capture value through our broad portfolio of assets and create effective capital allocation through the commodity cycle.

As we reflect on the accomplishments of our first five years as an independent company, the Board remains committed to leading governance policies. When CRC was spun off from its former parent in 2014,improve our governance reflected that of a new public company in a cyclical sector. Certain criteria were put in place at the outset, like separation of Chairmanstructure, enhance our abilities and CEO roles, an independent lead directorexpand our horizons. We frequently review best practices, host annual reviews, and a majorityencourage feedback from our shareholders. Each member of the Board being independent, while other key governance items were allowedis up for re-election this year and we would encourage you to mature with the Company. During my tenure and consistent with feedback fromvote at or prior to our shareholders, we have enhanced our governance profile, including moving away from a classified Board to an annual election of directors, introducing a majority voting standard for directors and instituting a more rigorous overboarding policy.

When we have had an opportunity for Board refreshment as a result of a director’s departure, we have thoughtfully sought replacements to broaden the Board’s knowledge and expertise as we continue to attract and maintain the most effective mix of Board talent. We regularly engage in a review process to evaluate desired skill sets that strengthen governance, promote diversity of thought and align with the evolving demands of our business. Today, we believe our Board’s experience in the energy industry, as well as in financial services, accounting, real estate, human resources and organizational disciplines, is well-suited for the many challenges that face CRC beyond challenges typically faced in the energy sector. Every year, we aim to improve shareholder outreach to obtain feedbackAnnual Meeting on our governance and compensation practices. The Board has utilized this feedback from shareholders to align a greater portion of executive compensation to shareholder returns, focus annual incentives on key measurable quantitative metrics and provide more detailed disclosure on the annual incentive payouts. We continue to focus management’s compensation on the actions that we feel will create long-term value, including further balance sheet strengthening, using a VCI metric for disciplined capital allocation, healthy EBITDAX generation, delivering excellent health, safety and environmental (HSE) performance and advancing sustainability projects that align with the State of California.

Although we’ve enhanced our governance and shareholder outreach in many ways, we have not been successful in obtaining shareholder approval on all the governance items that we have recommended to shareholders for adoption. For the past two years, we have recommended replacing our super majority voting provisions with majority vote requirements. Following two years of these shareholder proposals failing to garner the support of anywhere near the 75% of the outstanding shares required for approval, we have removed the proposals from the ballot this year. This decision was made by the Board after garnering

shareholder feedback on this and other governance issues. We expect to revisit this proposal again in the relatively near term, particularly if we see shifts in our shareholder base to more institutional ownership that we believe would increase the likelihood of our obtaining the approval of the requisite 75% of the outstanding shares.

We proudly operate critical energy infrastructure in California, the world’s fifth largest economy, under the most comprehensive and stringent oil and gas regulations. Hence our executive compensation metrics reflect the importance of this responsibility to address Californians’ energy needs and challenges in a manner that aims to meet community expectations. One of our most important achievements in 2019 was our health and safety record: CRC had zero recordable employee workplace injuries. On a combined basis, including contractors, we had an impressive injury and illness incidence rate (IIR) of 0.34 per 200,000 hours worked, which is better than safety statistics in the insurance and finance sectors according to the latest data available from the U.S. Bureau of Labor Statistics. For comparison, the average IIR for all employers in the U.S. in 2018 was 3.1, an injury rate nine times higher than what CRC’s workforce achieved.

Management has also been effectively progressing towards the Board’s four 2030 Sustainability Goals, which include specific quantitative targets for water recycling, reduction of methane emissions, integrating renewable power in our operations and carbon capture and sequestration. These goals align directly with those of the State of California and are measured against a 2013 baseline, the year before CRC launched. CRC has surpassed its methane target with a 60-percent reduction in methane emissions since 2013 and is almost halfway to its water target of a 30-percent increase in its water recycling volume. In 2019, CRC designed two 2-MW solar projects, and initiated solar projects that would provide up to an additional 40 MW at multiple CRC fields. CRC commenced a front-end engineering and design study on carbon capture at Elk Hills, one of nine such projects in the U.S. that received financial support from the U.S. Department of Energy in 2019. We were also quite pleased to receive validation of our sustainability efforts by receiving an A- from CDP (formerly known as the Carbon Disclosure Project) for our 2019 climate disclosure, scoring at CDP’s Leadership Level. CRC received the highest ranking among all U.S. oil and gas companies, tying for first with one other U.S.-based E&P company. This recognition highlights CRC’s differentiated value as a California E&P and the company’s ongoing commitment to provide sustainable, safe and reliable energy solutions for Californians.

We are focused on fostering diversity across the organization, including in the composition of our Board and management, as well as in recruiting and developing a workforce that reflects the diversity of the communities where we operate. We believe that CRC’s culture has progressed significantly in the past five years, from that of its former multi-national parent, to an engaged and entrepreneurial culture grounded in the company’s core values and focused on delivering local solutions to meet the needs of Californians. CRC’s strong culture of service empowers employees to champion the communities they live and work in and supports them in leading our community outreach. CRC’s work with community groups focuses on supporting diverse members of the community including working families of all ethnic groups, with an emphasis on veterans and women, as well as public health and safety and fostering science, technology, engineering and mathematics (STEM) education and workforce development. The Board frequently receives company-wide employee feedback that aids in providing insight into the company’s culture, managerial effectiveness and diversity. Our employees embrace the entrepreneurial “One CRC” mindset that promotes innovative thinking, increased collaboration and accountability and a focus on process improvements in everything we do. We are proud of our track record in pursuing opportunities to improve the lives of Californians and managing the risks of the business with a keen focus on Environmental, Social and Governance attributes that align well with the State of California, our employees and our investors. The Board will carry this active oversight forward in 2020 and beyond as we guide management as they continue to strengthen the balance sheet, capture the full value of our robust portfolio and promote effective capital allocation. May 4, 2022.

On behalf of the entire Board, I thank you for your support and engagement.

The Board and I are pleased with the tremendous progress CRC has made over the past five years as we’ve worked to become a stronger independent company. As we enter a new decade, we are focused on delivering value for shareholders by strengthening our balance sheet, effectively allocating human and financial capital and continuously improving our already strong operational and HSE performance.Tiffany (TJ) Thom Cepak

Regards,

William E. Albrecht

ChairmanChair of the Board

California Resources Corporation

PLEASE NOTE: This letter and the Proxy Statement contain forward-looking statements that involve risks and uncertainties that could materially affect our expected results of operations, liquidity, cash flows and business prospects. For a discussion of these risks and uncertainties, please refer to the “Risk Factors” and “Forward-Looking Statements” described in our Annual Report on Form 10-K. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “goal,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “project,” “seek,” “should,” “target,” “will” or “would” and similar words that reflect the prospective nature of events or outcomes typically identify forward-looking statements. Such statements are based on management's expectations as of the date of this filing, unless an earlier date is specified, and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Readers are urged to carefully review and consider the various disclosures made in our Form 10-K and in other documents we file from time to time with the SEC that disclose risks and uncertainties that may affect our business. Any forward-looking statement speaks only as of the date on which such statement is made and we undertake no obligation and expressly disclaim any duty to correct or update any forward-looking statement, except as required by applicable law.

We have included in this letter and the Proxy Statement certain voluntary disclosures regarding our Sustainability Goals, Sustainability Reports and related matters because we believe these matters are of interest to our investors; however, we do not believe these disclosures are “material” as that concept is defined by or construed in accordance with the securities laws or any other laws of the U.S. or any other jurisdiction, or as that concept is used in the context of financial statements and financial reporting. These disclosures speak only as of the date on which they are made, and we undertake no obligation and expressly disclaim any duty to correct or update such disclosures, whether as a result of new information, future events or otherwise, except as required by applicable law.

California Resources Corporation

|

Notice of the 20202022 Annual Meeting of Stockholders

Meeting Date: | May |

|

|

Meeting Time: | 11:00 a.m., |

|

|

Location: |

|

|

|

Record Date: | March |

Purposes of the 20202022 annual meeting of stockholders:

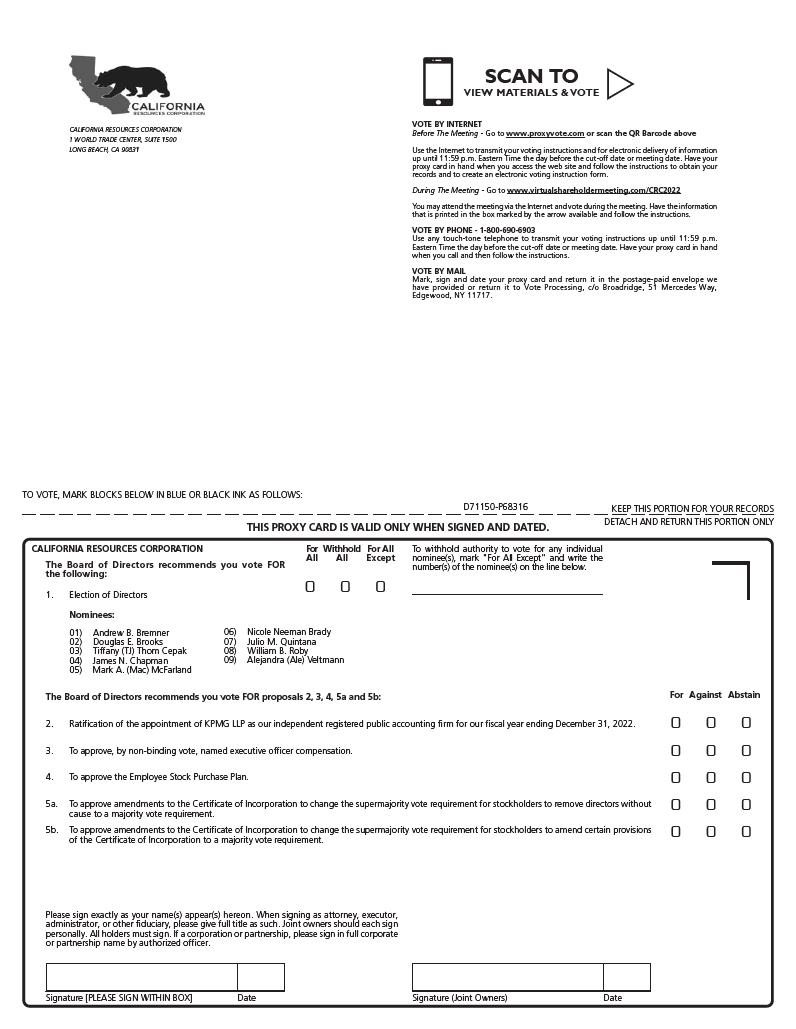

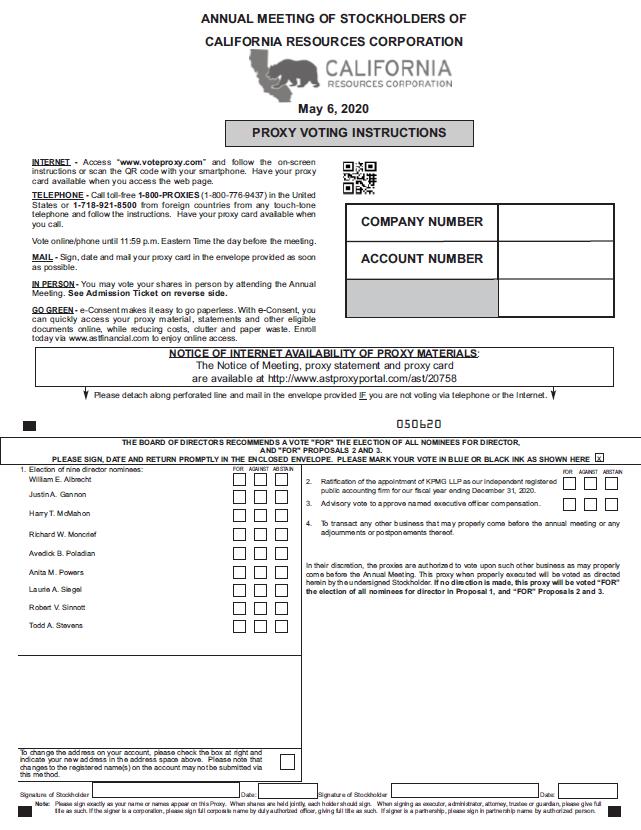

| (1) | To elect the nine director nominees named in this proxy statement, each to a one-year term; |

| (2) | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, |

| (3) | To hold an advisory vote to approve named executive officer |

(4) | To approve the Employee Stock Purchase Plan; |

(5a) | To approve amendments to the Certificate of Incorporation to change the supermajority vote requirement for stockholders to remove directors without cause to a majority vote requirement; and |

(5b) | To approve amendments to the Certificate of Incorporation to change the supermajority vote requirement for stockholders to amend certain provisions of the Certificate of Incorporation to a majority vote requirement. |

Information relevant to these matters is set forth in the accompanying proxy statement.

The close of business on March 9, 20207, 2022 was fixed as the record date for the determination of stockholders entitled to receive notice of and to vote at the annual meeting or any adjournment or postponement thereof. Only our stockholders of record or their legal proxy holders as of the record date or our invited guests may attend the annual meeting in person.

We intendThe annual meeting will be held in a virtual meeting format only at https://www.virtualshareholdermeeting.com/CRC2022. You will not be able to holdattend the annual meeting in person. However, we are actively monitoring the coronavirus (COVID-19); we are sensitivephysically. If you wish to the public health and travel concerns our stockholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to holdattend the annual meeting, in person, we will announce alternative arrangements foryou must follow the meeting as promptly as practicable, which may include holdinginstructions under “Attending the meeting partially or solely by meansAnnual Meeting” on page 67 of remote communication. Please monitor our annual meeting website at http://www.astproxyportal.com/ast/20758/ for updated information. If you are planning to attend our meeting, please check the website ten days prior toproxy statement. We have also provided information regarding how stockholders can engage during the meeting date. As always, we encourage you toAnnual Meeting, including how they can vote, your shares prior toask questions, request technical support and access information following the annual meeting.Annual Meeting within this proxy statement.

Beginning on March 24, 2020,22, 2022, we mailed a Notice of Internet Availability of Proxy Materials to our stockholders containing instructions on how to access the proxy statement and vote online and made our proxy materials available to our stockholders over the Internet.

By Order of the Board of Directors,

Michael L. Preston

Senior Executive Vice President, Chief Administrative Officer and General Counsel

Corporate Secretary

IMPORTANT VOTING INFORMATION

If you owned shares of our common stock at the close of business on March 9, 2020,7, 2022, you are entitled to one vote per share upon each matter presented at our 20202022 annual meeting of stockholders to be held on May 6, 2020.4, 2022. In order for stockholders whose shares were held in an account at a brokerage firm, bank or other nominee (i.e., in “street name”) as of March 9, 20207, 2022 to attendvote their shares at the 20202022 annual meeting, they will need to obtain a legal proxy from the broker, bank or other nominee that holds their shares authorizing them to vote in person at the annual meeting.

If you hold shares in “street name,” unless you provide specific instructions by completing and returning the voting instruction form or following the instructions provided to you to vote your shares via telephone or the Internet, your broker is only permitted to vote on your behalf on ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2020,2022, and may not vote on the election of directors and other matters to be considered at the annual meeting. For your vote to be counted,recognized, you will need to communicate your voting decisions to your broker, bank or other nominee before the date of the annual meeting.

YOUR VOTE IS IMPORTANT

Your vote is important. Our Board of Directors strongly encourages you to exercise your right to vote. Voting early helps ensure that we receive a quorum of shares necessary to hold the annual meeting.

QUESTIONS

If you have any questions about the proxy voting process, and you own shares that are registered in your own name, please contact AST Shareholder ServicesBroadridge at (866) 659-2647 or (718) 921-8124. If you have any questions about the proxy voting process, and your shares are held in “street name,” please contact the broker, bank or other nominee where you hold your shares.(800) 579-1639. The Securities and Exchange Commission also has a website (www.sec.gov/spotlight/proxymatters.shtml) with more information about your rights as a stockholder. You also may contact our Investor Relations Department by phone at (818) 661-6010661-3731 or by e-mail at IR@crc.com.

ATTENDING THE ANNUAL MEETING IN PERSON

Only stockholders of record or their legal proxy holders as of March 9, 2020 or our invited guests may attend theThe annual meeting will be held in person.a virtual meeting format only at If you planhttps://www.virtualshareholdermeeting.com/CRC2022. You will not be able to attend the annual meeting in person, you must present a valid form of government-issued photo identification, such as a driver’s license or passport. In addition to such personal identification, you will need an admission ticket or proof of ownership of CRC stock as of the record date to enter the annual meeting.physically. If your shares are registered in your name, you will find an admission ticket attached to the notice regarding the Internet availability of proxy materials or the proxy card sent to you. If your shares are held in street name with a broker, bank or other nominee, you will need to bring a copy of your brokerage statement or other documentation reflecting your stock ownership as of the record date for the meeting, and will need to obtain a proxy from your broker, bank or other nominee if you wish to vote in person atattend the annual meeting.meeting, you must follow the instructions under “Attending the Annual Meeting” on page 67 of the proxy statement.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF

PROXY MATERIALS FOR THE STOCKHOLDER MEETING

TO BE HELD ON MAY 6, 20204, 2022

The Notice of the 20202022 Annual Meeting of Stockholders, the Proxy Statement for the 20202022 Annual Meeting of Stockholders and the 20192021 Annual Report to Stockholders (which includes the Annual Report on Form 10-K for the fiscal year ended December 31, 2019)2021) of California Resources Corporation are available at http://www.astproxyportal.com/ast/20758/www.proxyvote.com. You will need the 16-digit control number included on the Notice that was mailed to you, on your proxy card or on the instructions that accompanied your proxy materials.

|

TABLE OF CONTENTSTable Of Contents

| |

1 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

24 | |

25 | |

25 | |

26 | |

|

|

|

|

|

|

|

|

| |

38 | |

38 | |

38 | |

38 | |

| |

| |

| |

| |

| |

| |

38 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

CALIFORNIA RESOURCES CORPORATION i

|

Proxy Statement Summary

Proxy StatementStatement Summary

This summary highlights information contained in the proxy statement. This summary does not contain all of the information you should consider, and you should read the entire proxy statement carefully before voting. California Resources Corporation, together with its subsidiaries, is referred to herein as “we,” “our,” “us,” the “Company” or “CRC.” The 20202022 annual meeting of stockholders described below is referred to herein as the “Annual Meeting.”

20202022 Annual Meeting of Stockholders

Date: | May |

|

|

Time: | 11:00 a.m., |

|

|

Place: |

|

| |

|

|

Record Date: | March |

We intendThe Annual Meeting will be held in a virtual meeting format only at https://www.virtualshareholdermeeting.com/CRC2022. You will not be able to holdattend the Annual Meeting in person. However, we are actively monitoring the coronavirus (COVID-19); we are sensitivephysically. If you wish to the public health and travel concerns our stockholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to holdattend the Annual Meeting, in person, we will announce alternative arrangements foryou must follow the meeting as promptly as practicable, which may include holding the meeting partially or solely by means of remote communication. Please monitor our Annual Meeting website at http://www.astproxyportal.com/ast/20758/ for updated information. If you are planning to attend our meeting, please check the website ten days prior to the meeting date. As always, we encourage you to vote your shares prior toinstructions under “Attending the Annual Meeting.Meeting” below.

Agenda and the Board’s Recommendation on Voting Matters

The following table summarizes the items that will be brought for a vote of our stockholders at the annual meeting, along with the recommendation of our Board of Directors as to how stockholders should vote on each item.

Agenda Item |

|

|

| Description |

| Board’s | |

1. |

| Proposal 1 |

| Election of the nine director nominees named in this proxy statement each for a one-year term |

| FOR | |

2. |

| Proposal 2 |

| Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal |

| FOR | |

3. |

| Proposal 3 |

| Advisory vote to approve named executive officer compensation | FOR | ||

4. | Proposal 4 | Approval of the Employee Stock Purchase Plan | FOR | ||||

5. | Proposal 5(a) | Approval of amendments to the Certificate of Incorporation to change the supermajority vote requirement for stockholders to remove directors without cause to a majority vote requirement | FOR | ||||

Proposal 5(b) | Approval of amendments to the Certificate of Incorporation to change the supermajority vote requirement for stockholders to amend certain provisions of the Certificate of Incorporation to a majority vote requirement |

| FOR | ||||

Voting: Stockholders as of the record date are entitled to vote. Each share of common stock entitles its holder to one vote for each director nominee and one vote for each of the proposals to be voted on.

CALIFORNIA RESOURCES CORPORATION 1

|

Proxy Statement Summary

TheAs of the Annual Meeting, the Board of Directors iswill be comprised of nineeight independent directors, including our Chairman, plus Mr. McFarland, our President and Chief Executive Officer (“CEO”). The following table provides summary information about each director and whether the Board of Directors considers each director to be independent under the New York Stock Exchange’s (“NYSE”) independence standards. We have adopted majority voting with respect to the uncontested election of directors toAlthough he is not currently independent, the Board has determined that Mr. Bremner will be independent as of Directors. See “Required Vote and Methodthe date of Counting–Majority Voting for Directors” below.

|

|

|

| Director | Committees | |||

Director | Positions | Age | Independent | Since | Audit | Compensation | Sustainability | Governance |

William E. Albrecht | Chairman | 68 | Yes | 2014 |

|

|

|

|

Justin A. Gannon |

| 70 | Yes | 2014 | Chair | ● |

|

|

Harold M. Korell * | Lead Independent Director | 75 | Yes | 2014 |

|

| ● | ● |

Harry T. McMahon |

| 66 | Yes | 2017 | ● | Chair |

|

|

Richard W. Moncrief |

| 77 | Yes | 2014 | ● |

| Chair |

|

Avedick B. Poladian |

| 68 | Yes | 2014 |

| ● |

| ● |

Anita M. Powers |

| 64 | Yes | 2017 |

|

| ● |

|

Laurie A. Siegel |

| 64 | Yes | 2018 | ● | ● |

|

|

Robert V. Sinnott |

| 70 | Yes | 2014 |

|

|

| Chair |

Todd A. Stevens | President & CEO | 53 | No | 2014 |

|

|

|

|

* Mr. Korell is not standing for reelection, and his term will expire at the 2020 Annual Meeting. Each director is elected by a plurality of votes cast.

|

|

|

|

| Committees | |||

|

|

|

| Director |

|

| Nominating & |

|

Director | Positions | Age | Independent | Since | Audit | Compensation | Governance | Sustainability |

Andrew B. Bremner |

| 31 | No | 2021 |

|

|

| ● |

Douglas E. Brooks |

| 63 | Yes | 2020 |

|

| ● |

|

Tiffany (TJ) Thom Cepak | Chair | 49 | Yes | 2020 | ● | ● |

|

|

James N. Chapman |

| 59 | Yes | 2020 |

| Chair | ● |

|

Mark A. (Mac) McFarland | President & CEO | 52 | No | 2020 |

|

|

|

|

Nicole Neeman Brady |

| 41 | Yes | 2021 |

| ● |

| ● |

Julio M. Quintana |

| 62 | Yes | 2020 | ● |

| Chair |

|

William B. Roby |

| 62 | Yes | 2020 | ● | ● |

| Chair |

Alejandra (Ale) Veltmann |

| 53 | Yes | 2021 | Chair |

|

|

|

Corporate Governance Highlights

| ✓ |

|

✓ | 8 out of 9 Board members are independent. The Board has determined 8 out of 9 Board members are independent within the meaning of NYSE listing standards as of the date of the Annual Meeting. |

| ✓ | Anti-Hedging and Anti-Pledging Policy. |

| ✓ | Overboarding Policy. |

| ✓ | Clawback Policy. |

| ✓ | Board is not classified. Our directors are elected on an annual basis. |

| ✓ |

|

|

|

| Independent Board committees. |

| ✓ | Each committee has the authority to retain independent advisors. |

| ✓ | Frequent executive sessions of independent directors. In |

| ✓ | No stockholder rights plan (“poison pill”) in effect. |

| ✓ | Director evaluation process. Each year, each of the Board committees and the full Board of Directors undertakes a self-assessment of its performance. |

| ✓ | CEO and management evaluation process. The Board of Directors conducts an annual performance review of management, including the CEO, and periodically reviews succession planning for the CEO. |

CALIFORNIA RESOURCES CORPORATION 2

|

Proxy Statement Summary

Business Performance Highlights

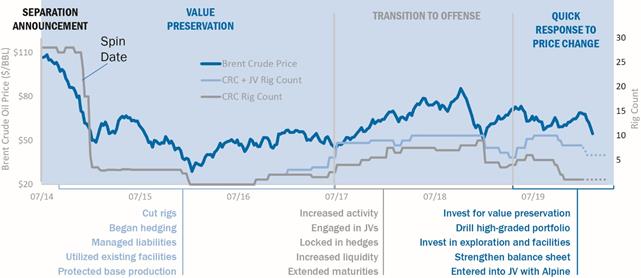

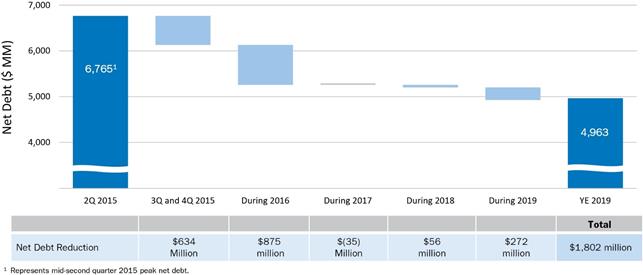

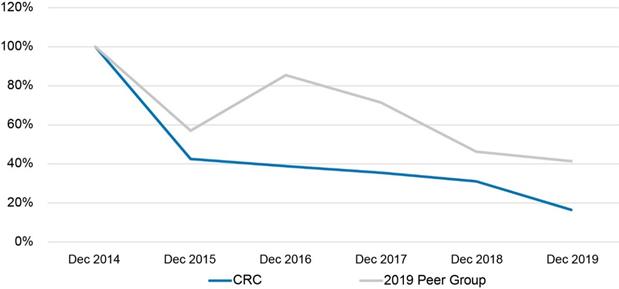

In 2019, our management team delivered significant accomplishments against our strategic priorities which the Compensation Committee considered as part of its review of management’s performance for compensation purposes.

|

|

|

|

|

|

|

|

CALIFORNIA RESOURCES CORPORATION 3

|

Proxy Statement Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation Program Highlights

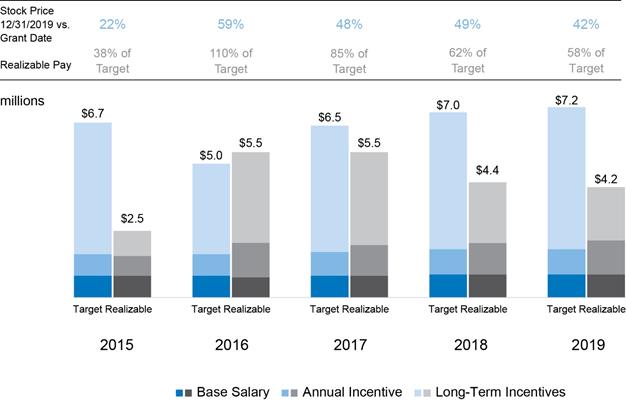

CRC’s stock price performanceIn connection with the unprecedented circumstances affecting the industry and market volatility resulting from the COVID-19 pandemic, beginning in 2019 continuedMarch 2020, the Former Compensation Committee (as defined below) reviewed the annual and long-term incentive programs to be very volatile, endingdetermine whether those programs appropriately aligned compensation opportunities with the year at depressed levels, drivenCompany’s then current goals and ensured the stability of the Company’s workforce. Following this review, in large part byMay 2020, the highly leveraged balance sheetFormer Compensation Committee approved changing the incentive compensation program for the organization, including the NEOs, to an all cash program consisting of a Retention Bonus Award and a Quarterly Incentive Award.

Following our management team inheritedemergence from Occidental Petroleum Corporation (“Occidental”) atthe bankruptcy process, our Spin-off from Occidental (the “Spin-off”), and the performance continued to impact the realizable compensationNew Compensation Committee (as defined below) immediately began setting a new course for our named executive officers. For 2019, our Compensation Committee continued the alignment of thepost-emergence compensation program, reinstituting long-term performance equity awards in line with compensation to stockholder returns by granting entirely share-based long-term incentive awards.

CALIFORNIA RESOURCES CORPORATION 4

|

Proxy Statement Summary

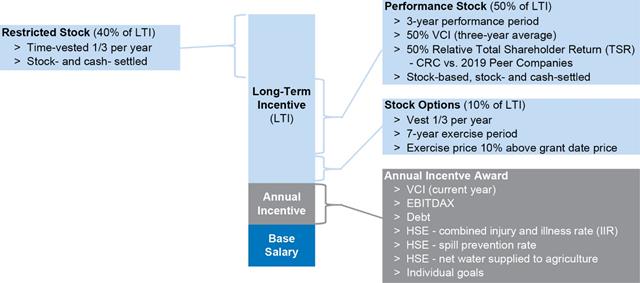

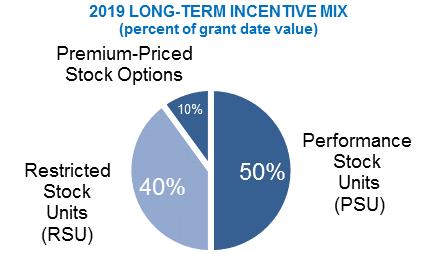

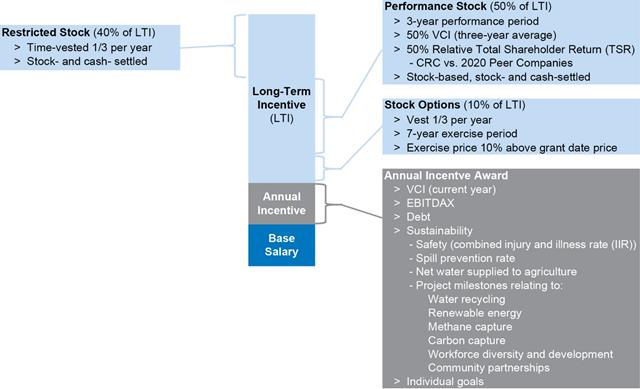

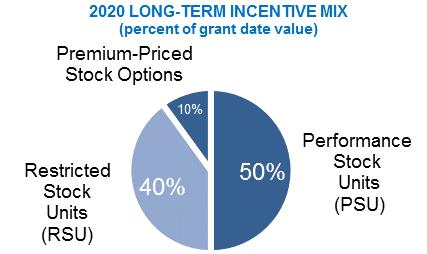

In the first quarter of 2019, based on feedback received from stockholder outreach, the Compensation Committee took the following actions:

Reduced the number of metrics under the annual incentive awards to provide greater focus on key objectives.

Set the performance targets under the annual incentive awards at more rigorous levels than the prior year.

Changed the performance criteria under the long-term performance-based award to be based 50% on the three-year average VCIbest practices and 50% on three-year relative total shareholder return (“TSR”).good governance policies.

Compensation Program PracticesCalifornia Resources Corporation

Our executive compensation program

PLEASE NOTE: This letter and the Proxy Statement contain forward-looking statements that involve risks and uncertainties that could materially affect our expected results of operations, liquidity, cash flows and business prospects. For a discussion of these risks and uncertainties, please refer to the “Risk Factors” and “Forward-Looking Statements” described in our Annual Report on Form 10-K. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “goal,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “project,” “seek,” “should,” “target,” “will” or “would” and similar words that reflect the prospective nature of events or outcomes typically identify forward-looking statements. Such statements are based on management's expectations as of the date of this filing, unless an earlier date is designedspecified, and involve many risks and uncertainties that could cause our actual results to motivatediffer materially from those expressed or implied in our executivesforward-looking statements. Given these risks and uncertainties, readers are cautioned not to take actions thatplace undue reliance on such forward-looking statements. Readers are aligned withurged to carefully review and consider the various disclosures made in our short-Form 10-K and long-term strategic objectives, appropriately balancing risk versus potential reward. It is well designed, incorporating best practices, and is governed by an engaged Compensation Committee. Our annual incentive awards and long-term incentive plans are performance-based and are intendedin other documents we file from time to aligntime with the long-term best interestsSEC that disclose risks and uncertainties that may affect our business. Any forward-looking statement speaks only as of stockholdersthe date on which such statement is made and retainwe undertake no obligation and expressly disclaim any duty to correct or update any forward-looking statement, except as required by applicable law.

We have included in this letter and the Proxy Statement certain voluntary disclosures regarding our highly experienced, high-performing management team.

The Compensation Committee has engagedSustainability Goals, Sustainability Reports and related matters because we believe these matters are of interest to our investors; however, we do not believe these disclosures are “material” as that concept is defined by or construed in best practices to align executive payaccordance with Company performance and to ensure good governancethe securities laws or any other laws of the U.S. or any other jurisdiction, or as that concept is used in the following ways:context of financial statements and financial reporting. These disclosures speak only as of the date on which they are made, and we undertake no obligation and expressly disclaim any duty to correct or update such disclosures, whether as a result of new information, future events or otherwise, except as required by applicable law.

Notice of the 2022 Annual Meeting of Stockholders

Meeting Date: | May 4, 2022 |

Meeting Time: | 11:00 a.m., Pacific Time |

Location: | Virtual meeting at https://www.virtualshareholdermeeting.com/CRC2022 |

Record Date: | March 7, 2022 |

Purposes of the 2022 annual meeting of stockholders:

(1) | To elect the nine director nominees named in this proxy statement, each to a one-year term; |

(2) | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; |

(3) | To hold an advisory vote to approve named executive officer compensation; |

(4) | To approve the Employee Stock Purchase Plan; |

(5a) | To approve amendments to the Certificate of Incorporation to change the supermajority vote requirement for stockholders to remove directors without cause to a majority vote requirement; and |

(5b) | To approve amendments to the Certificate of Incorporation to change the supermajority vote requirement for stockholders to amend certain provisions of the Certificate of Incorporation to a majority vote requirement. |

Information relevant to these matters is set forth in the accompanying proxy statement.

The close of business on March 7, 2022 was fixed as the record date for the determination of stockholders entitled to receive notice of and to vote at the annual meeting or any adjournment or postponement thereof. Only our stockholders of record or their legal proxy holders as of the record date or our invited guests may attend the annual meeting in person.

The annual meeting will be held in a virtual meeting format only at https://www.virtualshareholdermeeting.com/CRC2022. You will not be able to attend the annual meeting physically. If you wish to attend the annual meeting, you must follow the instructions under “Attending the Annual Meeting” on page 67 of the proxy statement. We have also provided information regarding how stockholders can engage during the Annual Meeting, including how they can vote, ask questions, request technical support and access information following the Annual Meeting within this proxy statement.

Beginning on March 22, 2022, we mailed a Notice of Internet Availability of Proxy Materials to our stockholders containing instructions on how to access the proxy statement and vote online and made our proxy materials available to our stockholders over the Internet.

By Order of the Board of Directors,

Michael L. Preston

Executive Vice President, Chief Administrative Officer and General Counsel

Corporate Secretary

IMPORTANT VOTING INFORMATION

If you owned shares of our common stock at the close of business on March 7, 2022, you are entitled to one vote per share upon each matter presented at our 2022 annual meeting of stockholders to be held on May 4, 2022. In order for stockholders whose shares were held in an account at a brokerage firm, bank or other nominee (i.e., in “street name”) as of March 7, 2022 to vote their shares at the 2022 annual meeting, they will need to obtain a legal proxy from the broker, bank or other nominee that holds their shares authorizing them to vote in person at the annual meeting.

If you hold shares in “street name,” unless you provide specific instructions by completing and returning the voting instruction form or following the instructions provided to you to vote your shares via telephone or the Internet, your broker is only permitted to vote on your behalf on ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2022, and may not vote on the election of directors and other matters to be considered at the annual meeting. For your vote to be recognized, you will need to communicate your voting decisions to your broker, bank or other nominee before the date of the annual meeting.

YOUR VOTE IS IMPORTANT

Your vote is important. Our Board of Directors strongly encourages you to exercise your right to vote. Voting early helps ensure that we receive a quorum of shares necessary to hold the annual meeting.

QUESTIONS

If you have any questions about the proxy voting process, please contact Broadridge at (800) 579-1639. The Securities and Exchange Commission also has a website (www.sec.gov/spotlight/proxymatters.shtml) with more information about your rights as a stockholder. You also may contact our Investor Relations Department by phone at (818) 661-3731 or by e-mail at IR@crc.com.

ATTENDING THE ANNUAL MEETING

The annual meeting will be held in a virtual meeting format only at https://www.virtualshareholdermeeting.com/CRC2022. You will not be able to attend the annual meeting physically. If you wish to attend the annual meeting, you must follow the instructions under “Attending the Annual Meeting” on page 67 of the proxy statement.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF

PROXY MATERIALS FOR THE STOCKHOLDER MEETING

TO BE HELD ON MAY 4, 2022

The Notice of the 2022 Annual Meeting of Stockholders, the Proxy Statement for the 2022 Annual Meeting of Stockholders and the 2021 Annual Report to Stockholders (which includes the Annual Report on Form 10-K for the fiscal year ended December 31, 2021) of California Resources Corporation are available at http://www.proxyvote.com. You will need the 16-digit control number included on the Notice that was mailed to you, on your proxy card or on the instructions that accompanied your proxy materials.

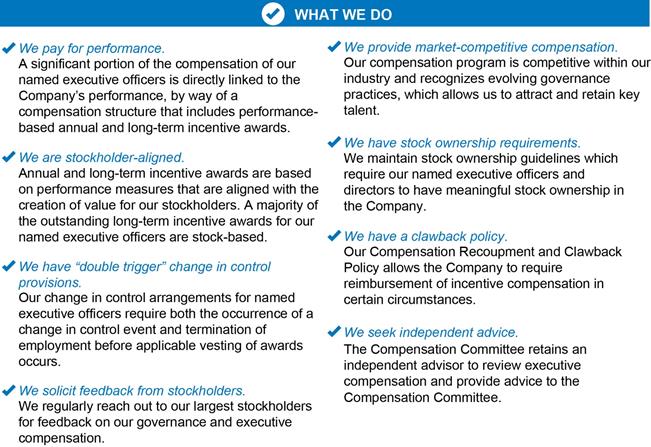

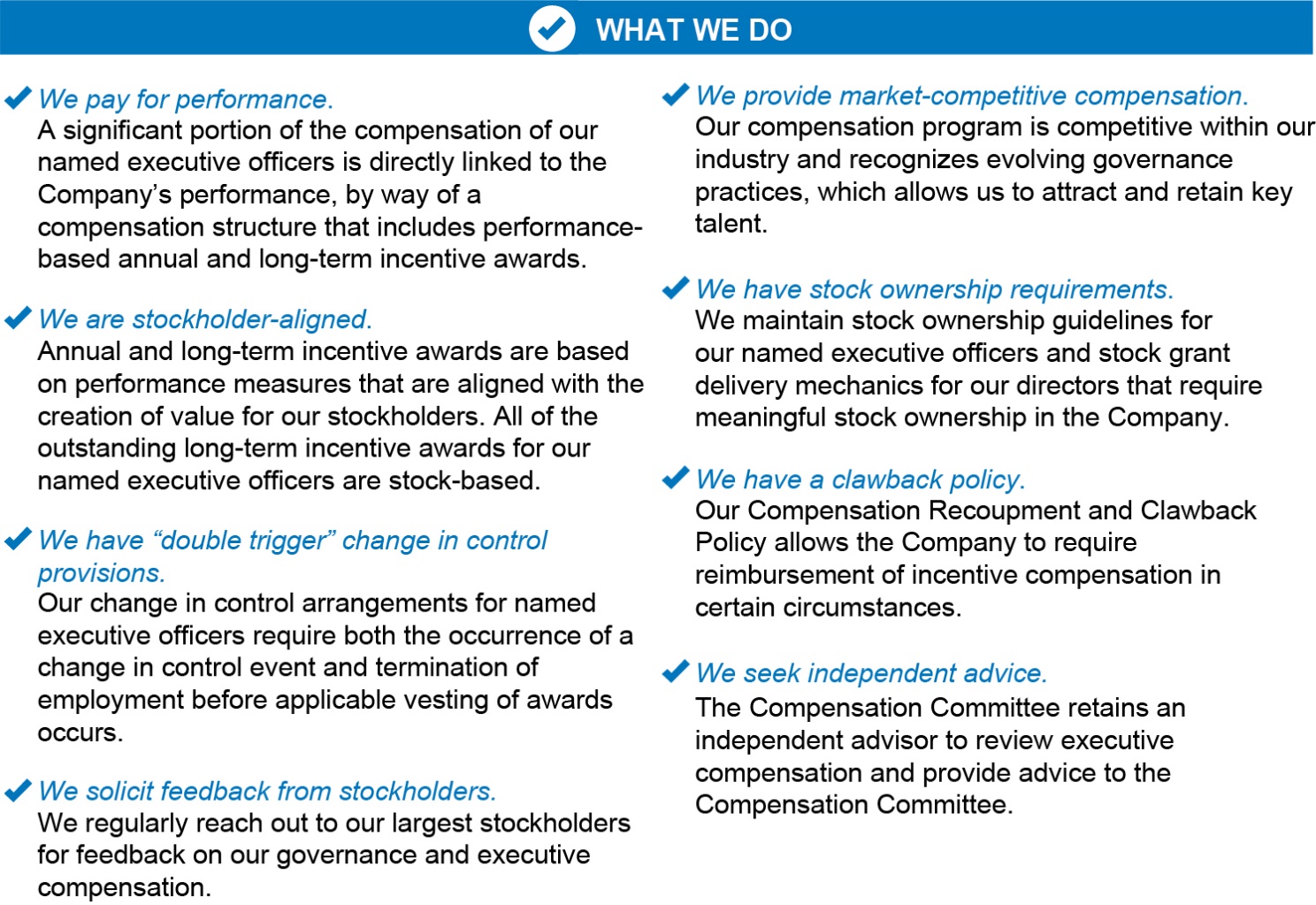

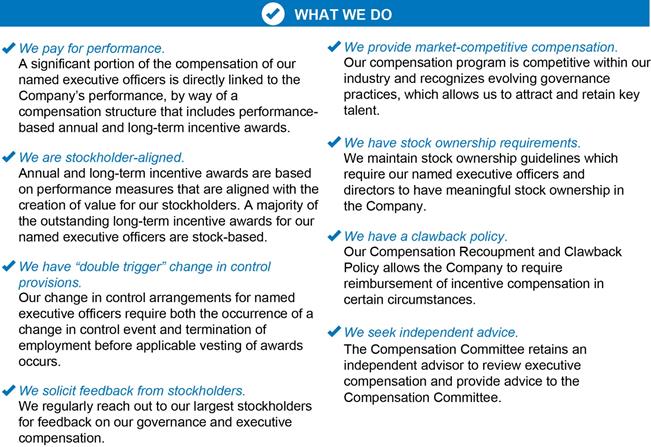

WHAT WE DO We pay for performance. A significant portion of the compensation of our named executive officers is directly linked to the Company’s performance, by way of a compensation structure that includes performance-based annual and long-term incentive awards. We are stockholder-aligned. Annual and long-term incentive awards are based on performance measures that are aligned with the creation of value for our stockholders. A majority of the outstanding long-term incentive awards for our named executive officers are stock-based. We have “double trigger” change in control provisions. Our change in control arrangements for named executive officers require both the occurrence of a change in control event and termination of employment before applicable vesting of awards occurs. We provide market-competitive compensation. Our compensation program is competitive within our industry and recognizes evolving governance practices, which allows us to attract and retain key talent. We have stock ownership requirements. We maintain stock ownership guidelines which require our named executive officers and directors to have meaningful stock ownership in the Company. We have a clawback policy. Our Compensation Recoupment and Clawback Policy allows the Company to require reimbursement of incentive compensation in certain circumstances. We seek independent advice. The Compensation Committee retains an independent advisor to review executive compensation and provide advice to the Compensation Committee.

CALIFORNIA RESOURCES CORPORATION 5

|

Table Of Contents

1 | |

5 | |

5 | |

13 | |

13 | |

13 | |

13 | |

13 | |

14 | |

14 | |

14 | |

14 | |

15 | |

15 | |

15 | |

19 | |

19 | |

20 | |

20 | |

20 | |

20 | |

21 | |

22 | |

23 | |

24 | |

25 | |

25 | |

26 | |

34 | |

34 | |

36 | |

36 | |

36 | |

38 | |

38 | |

38 | |

38 | |

38 | |

38 | |

39 | |

39 | |

39 | |

39 | |

39 | |

40 |

CALIFORNIA RESOURCES CORPORATION i

2022 PROXY STATEMENT |

Proxy Statement Summary

WHAT WE DON’T DO We do not have individual employment agreements. We do not have employment agreements with any of our named executive officers. We do not allow hedging or pledging. Our Insider Trading Policy prohibits certain transactions involving our stock, including hedging and pledging. We do no allow the repricing of stock options. Our equity incentive plan prohibits the repricing or backdating of stock options. We do not offer enhanced retirement benefits. Our nonqualified defined compensation plan provides restorative, but not enhanced, retirement benefits for executives. We do no encourage excessive risk or inappropriate risk taking through our incentive programs. Our plans do not motivate executives or inappropriate risk for the Company.

WHAT WE DON’T DO We do not have individual employment agreements. We do not have employment agreements with any of our named executive officers. We do not allow hedging or pledging. Our Insider Trading Policy prohibits certain transactions involving our stock, including hedging and pledging. We do not allow the repricing of stock options. Our equity incentive plan prohibits the repricing or backdating of stock options. We do not offer enhanced retirement benefits. Our nonqualified defined compensation plan provides restorative, but not enhanced, retirement benefits for executives. We do not encourage excessive risk or inappropriate risk taking through our incentive programs. Our plans do not motivate executives to engage in activities that create excessive or inappropriate risk for the Company.

CALIFORNIA RESOURCES CORPORATION 6

|

Board of Directors and Corporate Governance

This summary highlights information contained in the proxy statement. This summary does not contain all of Directorsthe information you should consider, and Corporate Governanceyou should read the entire proxy statement carefully before voting. California Resources Corporation, together with its subsidiaries, is referred to herein as “we,” “our,” “us,” the “Company” or “CRC.” The 2022 annual meeting of stockholders described below is referred to herein as the “Annual Meeting.”

Our Board of Directors has nominated nine directors for election at the 2020 Annual Meeting. All of our nominees currently serve as CRC directors. Each nominee has agreed to serve another term, if elected.

After serving on our Board since our Spin-off, Mr. Korell will not be standing for reelection to the Board of Directors this year. This decision is not due to any disagreement with the Company on any matters relating to the Company’s operations, policies or practices. As a result, Mr. Korell’s term will expire at the 20202022 Annual Meeting at which time the size of the Board of Directors will be reduced from ten to nine directors.

Our Board exhibits an effective mix of diversity, perspective, skills and experience.

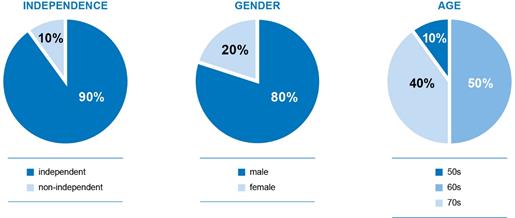

INDEPENDENCE 10% 90% independent non-independent GENDER 20% 80% male female AGE 10% 40% 50% 50s 60s 70s

Independence 10% non-independent 90% independent Gender 20% female 80% male AGE 10% 50s 50% 60s 40% 70s

Set forth below is a chart that summarizes the core competencies of our Board, and biographical information regarding each of our directors as well as the specific experience, qualifications, attributes and skills that led to the conclusion that such individual should serve as director. There are no family relationships between any of our directors and executive officers. In addition, there are no arrangements or understandings between any of our executive officers or directors and any other person pursuant to which any person was selected as a director or an executive officer.

Director Skills and QualificationsStockholders

Date: | May 4, 2022 |

Time: | 11:00 a.m., Pacific Time |

Place: | Virtual meeting at https://www.virtualshareholdermeeting.com/CRC2022 |

Record Date: | March 7, 2022 |

The Annual Meeting will be held in a virtual meeting format only at https://www.virtualshareholdermeeting.com/CRC2022. You will not be able to attend the Annual Meeting physically. If you wish to attend the Annual Meeting, you must follow the instructions under “Attending the Annual Meeting” below.

Agenda and the Board’s Recommendation on Voting Matters

The following table summarizes the items that will be brought for a vote of our stockholders at the annual meeting, along with the recommendation of our Board of Directors as to how stockholders should vote on each item.

Agenda Item |

|

|

| Description |

| Board’s | |||||

1. |

| ||||||||||

|

|

|

|

|

|

| Election of the nine director nominees named in this proxy statement each for a one-year term |

| FOR | ||

2. |

| Proposal 2 | Ratification of | FOR | |||||||

3. | Proposal 3 | Advisory vote to approve named executive officer compensation | FOR | ||||||||

4. | Proposal 4 | Approval of the Employee Stock Purchase Plan | FOR | ||||||||

5. | Proposal 5(a) | Approval of amendments to the Certificate of Incorporation to change the supermajority vote requirement for stockholders to remove directors without cause to a majority vote requirement | FOR | ||||||||

|

| Proposal 5(b) |

| Approval of amendments to the Certificate of Incorporation to change the supermajority vote requirement for stockholders to amend certain provisions of the Certificate of Incorporation to a majority vote requirement |

| ||||||

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| ||||

FOR | |||||||||||

Voting: Stockholders as of the record date are entitled to vote. Each share of common stock entitles its holder to one vote for each director nominee and one vote for each of the proposals to be voted on.

CALIFORNIA RESOURCES CORPORATION 71

|

Proxy Statement Summary

Directors

As of the Annual Meeting, the Board of Directors will be comprised of eight independent directors, plus Mr. McFarland, our President and Chief Executive Officer (“CEO”). The following table provides summary information about each director and whether the Board of Directors considers each director to be independent under the New York Stock Exchange’s (“NYSE”) independence standards. Although he is not currently independent, the Board has determined that Mr. Bremner will be independent as of the date of the Annual Meeting. Each director is elected by a plurality of votes cast.

|

|

|

|

| Committees | |||

|

|

|

| Director |

|

| Nominating & |

|

Director | Positions | Age | Independent | Since | Audit | Compensation | Governance | Sustainability |

Andrew B. Bremner |

| 31 | No | 2021 |

|

|

| ● |

Douglas E. Brooks |

| 63 | Yes | 2020 |

|

| ● |

|

Tiffany (TJ) Thom Cepak | Chair | 49 | Yes | 2020 | ● | ● |

|

|

James N. Chapman |

| 59 | Yes | 2020 |

| Chair | ● |

|

Mark A. (Mac) McFarland | President & CEO | 52 | No | 2020 |

|

|

|

|

Nicole Neeman Brady |

| 41 | Yes | 2021 |

| ● |

| ● |

Julio M. Quintana |

| 62 | Yes | 2020 | ● |

| Chair |

|

William B. Roby |

| 62 | Yes | 2020 | ● | ● |

| Chair |

Alejandra (Ale) Veltmann |

| 53 | Yes | 2021 | Chair |

|

|

|

Corporate Governance

Highlights

| ✓ | Supermajority votes. As part of our emergence from bankruptcy, our Bylaws were revised to reduce the prior supermajority voting threshold to amend the Bylaws to a majority vote. The Board is submitting for approval proposals to amend the Company’s Certificate of Incorporation to reduce the current supermajority voting thresholds to majority thresholds. |

| ✓ | 8 out of 9 Board members are independent. The Board has determined 8 out of 9 Board members are independent within the meaning of NYSE listing standards as of the date of the Annual Meeting. |

|

|

|

|

|

|

|

Mr. Albrecht has served on the Board of Directors of CRC since 2014. He was appointed as Chairman of the Board in 2016. He served as Executive Chairman of the Board of Directors from 2014 to 2016. Mr. Albrecht served as Vice President of Occidental from 2008 to 2014 and as President, Oxy Oil & Gas, Americas from 2012 to 2014. Mr. Albrecht also served as President—Oxy Oil & Gas, USA from 2008 to 2012. During his tenure with Occidental, Mr. Albrecht had managerial oversight over its upstream assets. Mr. Albrecht has more than 40 years of experience in the domestic oil and gas industry, having previously served as an executive officer for domestic energy producer EOG Resources, and as a petroleum engineer for Tenneco Oil Company. Since 2015, Mr. Albrecht has served on the board of directors of Valaris plc (formerly the Rowan Companies, plc), an international offshore drilling contractor providing jackups and drill ships for the offshore drilling industry. Mr. Albrecht is a member of its Compensation Committee and Nominating, Governance and Sustainability Committee, and is its Lead Independent Director. Since 2016, Mr. Albrecht has served on the board of directors of Halliburton Co. and is a member of its Compensation Committee and Health, Safety and Environment Committee. Since February 2020, Mr. Albrecht has served on the board of directors of Laredo Petroleum, Inc. and is a member of its Compensation Committee and its Nominating and Corporate Governance Committee. Mr. Albrecht holds a Master of Science degree from the University of Southern California and a Bachelor of Science degree from the United States Military Academy. Mr. Albrecht is a National Association of Corporate Directors (“NACD”) Board Leadership Fellow, and has completed NACD’s comprehensive program of study for directors and corporate governance professionals.

Skills and Qualifications

Mr. Albrecht brings extensive managerial and operational experience in the upstream domestic and international energy business to the Board of Directors. He also has a deep knowledge of our assets that gives the Board a valuable perspective on the specific strengths and challenges associated with our operations. Mr. Albrecht brings broad experience in proactively engaging with regulatory agencies, communities, and other stakeholders that makes him a valuable member of our Board of Directors.

✓ | Clawback Policy. We maintain a comprehensive, standalone policy that covers cash, equity, equity-based and other awards under our incentive compensation programs. |

✓ | Board is not classified. Our directors are elected on an annual basis. |

✓ | Independent Board committees. Our Audit, Compensation, and Nominating and Governance committees are made up of independent directors. As of the Annual Meeting, the Sustainability Committee will also be made up of independent directors. Each standing committee operates under a written charter that has been approved by the Board and is available to stockholders. |

✓ | Each committee has the authority to retain independent advisors. |

✓ | Frequent executive sessions of independent directors. In 2021, the independent directors held executive sessions on a regular basis. |

✓ | No stockholder rights plan (“poison pill”) in effect. |

✓ | Director evaluation process. Each year, each of the Board committees and the full Board of Directors undertakes a self-assessment of its performance. |

✓ | CEO and management evaluation process. The Board of Directors conducts an annual performance review of management, including the CEO, and periodically reviews succession planning for the CEO. |

CALIFORNIA RESOURCES CORPORATION 82

|

Board of Directors and Corporate GovernanceProxy Statement Summary

|

|

Compensation Program Highlights In connection with the unprecedented circumstances affecting the industry and market volatility resulting from the COVID-19 pandemic, beginning in March 2020, the Former

|

• Chairman of the Audit Committee

• Member of the Compensation Committee

Mr. Gannon has served on (as defined below) reviewed the Board of Directors of CRC since 2014. Since 2013, Mr. Gannon has acted as an independent consultantannual and private investor. From 2003long-term incentive programs to 2013, Mr. Gannon served in various roles at Grant Thornton LLP, an independent audit, tax and advisory firm, including as National Leader of Merger and Acquisition Development from 2011 to 2013, Central Region Managing Partner from 2010 to 2011, Office Managing Partner in Houston, Texas from 2007 to 2011 and Office Managing Partner in Kansas City, Missouri from 2004 to 2007. From 1971 to 2002, Mr. Gannon worked at Arthur Andersen LLP, including as an Audit Partner for 21 years. Mr. Gannon is also a Director, Chairman of the Audit Committee and Member of the Conflicts Committee of the general partner of CrossAmerica Partners LP, a publicly-traded master limited partnership engaged in motor fuels distribution. He served as a member of the board of directors and as audit committee chairman for Vantage Energy Acquisition Company from April 2017 until its liquidation in April 2019. Mr. Gannon is a former chairman of the Board of Directors of American Red Cross chapters in the Tulsa, Oklahoma and San Antonio, Texas areas. He received a Bachelor of Science degree in Accounting from Loyola Marymount University and is a Certified Public Accountant in Texas (active) and California (inactive).

Skills and Qualifications

Mr. Gannon’s more than four decades in financial accounting practice and his private investment experience give him deep insight into financial analysis and management. His experience is especially valuable to the Board because of the extent to which his clients were involved in oil and gas upstream exploration and production. His financial acumen enables Mr. Gannon to guide the Board in its fiscal and strategic oversight of CRC.

|

|

|

• Member of the Nominating and Governance Committee

• Member of the Sustainability Committee

Mr. Korell has served on the Board of Directors of CRC and as Lead Independent Director since 2014. From 2002 through 2014, Mr. Korell served as the Chairman of the Board of Southwestern Energy Company, an independent energy company engaged in natural gas and oil exploration, development and production. From

CALIFORNIA RESOURCES CORPORATION 9

|

Board of Directors and Corporate Governance

2009 to 2010, he served as Southwestern’s Executive Chairman and, from 1999 to 2009, as its Chief Executive Officer. From 1997 to 2009, Mr. Korell served in various other roles at Southwestern, including President and Executive Vice President and Chief Operating Officer. Prior to his tenure at Southwestern, Mr. Korell was Senior Vice President—Operations of American Exploration Company, Executive Vice President of McCormick Resources, held various technical and managerial positions during his 17 yearsdetermine whether those programs appropriately aligned compensation opportunities with Tenneco Oil Company, including Vice President of Production, and held various positions with Mobil Corporation. He is a member of the Society of Petroleum Engineers and, through 2010, served as a Board Member for the Independent Petroleum Association of America and the American Exploration & Production Council and as a Board Member and Executive Committee Member for America’s Natural Gas Alliance. He also serves on the Board of Governors at the Colorado School of Mines and is a Trustee Emeritus at the Baylor College of Medicine. Mr. Korell holds a degree in Chemical and Petroleum Refining Engineering from the Colorado School of Mines.

Skills and Qualifications

Mr. Korell’s experience over five decades in the oil and gas industry gives him a broad understanding of the upstream oil and gas business as well as the midstream and public utility businesses. Mr. Korell’s leadership during a time of dramatic expansion for his company provides valuable insights into strategic and operational, corporate and governance matters. In addition, Mr. Korell provides a deep understanding of our assets due to his involvement with a number of them early in his career that lend specific knowledge and understanding to Board discussions.

|

|

|

• Member of the Audit Committee

• Chairman of the Compensation Committee

Mr. McMahon has served on the Board of Directors of CRC since 2017. Since 2015 he has been a Senior Advisor to the G100 Network, a Leadership Advisory Consortium focused on CEO and Board Development. From 1983 to 2015, Mr. McMahon served in various positions for Bank of America Merrill Lynch including, most recently, as Executive Vice Chairman (the firm's first following the merger of Merrill Lynch and Bank of America). His other roles included service as Vice Chairman and Co-Head of Global Corporate Finance of Merrill Lynch and over 25 years running Investment Banking for the firm's Western Region. During his career Mr. McMahon advised on more than 400 transactions. Mr. McMahon is a director of Parsons Corporation, a digitally enabled solutions provider and a global leader in many diversified markets with a focus on security, defense and infrastructure, and is a member of its Audit and Compensation committees. Mr. McMahon also serves as a trustee of Claremont McKenna College. Mr. McMahon received a Master of Business Administration degree from the University of Chicago Booth School of Business and a Bachelor of Arts degree in Economics from Claremont McKenna College.

Skills and Qualifications

Mr. McMahon's over three decades of investment banking experience provides the Board with deep insight into financial structuring matters and fashioning innovative strategic solutions. His senior managerial roles, including as Executive Vice Chairman of one of the nation's largest banks and as Senior Advisor to the G100 Network, also give him valuable perspectives on maintaining ties between boards and management.

CALIFORNIA RESOURCES CORPORATION 10

|

Board of Directors and Corporate Governance

|

|

|

• Chairman of the Sustainability Committee

• Member of the Audit Committee

Mr. Moncrief has served on the Board of Directors of CRC since 2014. Mr. Moncrief has been a principal in Moncrief Oil International, Inc., an oil and gas exploration and production company with headquarters in Fort Worth, Texas, since founding the company in 1970. He currently serves as its Chief Executive Officer. Moncrief Oil participates in U.S. and international oil and gas exploration and production. Mr. Moncrief also serves on the boards of trustees for the Amon Carter Museum and the University of Texas Development Board. He holds a Bachelor of Science degree in Petroleum Engineering and is a Distinguished Graduate of the School of Engineering of the University of Texas.

Skills and Qualifications

Mr. Moncrief’s extensive experience as the head of a large private upstream oil and gas exploration company allows him to bring an in-depth understanding of key industry issues to the Board of Directors. His leadership experience at Moncrief Oil provides him with strategic and management insights from which CRC benefits. Mr. Moncrief offers entrepreneurial expertise forged over years in the business of oil and gas exploration.

|

|

|

• Member of the Compensation Committee

• Member of the Nominating and Governance Committee

Mr. Poladian has served on the Board of Directors of CRC since 2014. From 2006 to 2016, Mr. Poladian served as Executive Vice President and Chief Operating Officer of Lowe Enterprises, Inc., a diversified national real estate company active in commercial, residential and hospitality property investment, management and development. Mr. Poladian previously served as Executive Vice President, Chief Financial Officer and Chief Administrative Officer for Lowe from 2003 to 2006. Mr. Poladian was with Arthur Andersen LLP from 1974 to 2002, most recently as a Partner, and is a Certified Public Accountant (inactive). He is a past member of the Young Presidents Organization, the Chief Executive Organization, the California Society of CPAs and the American Institute of CPAs. Mr. Poladian is a director emeritus of the YMCA of Metropolitan Los Angeles, a member of the Board of Councilors of the USC Sol Price School of Policy, a member of the Board of Advisors of the Ronald Reagan UCLA Medical Center, and a former Trustee of Loyola Marymount

CALIFORNIA RESOURCES CORPORATION 11

|

Board of Directors and Corporate Governance

University. He serves as a director and on the Audit Committees of funds managed by Western Asset Management Funds. He is also a member of the Board of Trustees of Public Storage where he is the Chair of the Audit Committee and a member of the Nominating and Corporate Governance Committee. Mr. Poladian also serves as a director of Occidental Petroleum Corporation where he is a member of the Corporate Governance and Nominating Committee and Chair of the Audit Committee. He previously served as a director of California Pizza Kitchen.

Skills and Qualifications

Mr. Poladian’s service in a senior management position at one of the world’s largest accounting firms, combined with his experience as Chief Operating Officer and Chief Financial Officer of a diversified real estate company, gives Mr. Poladian deep knowledge of key business issues, including personnel and asset utilization. He also provides insight into all aspects of fiscal management. Through his work on the boards of various entities, Mr. Poladian has garnered valuable insight into our business and corporate governance generally.

|

|

|

• Member of the Sustainability Committee

Ms. Powers was appointed to the Board of Directors in 2017. Ms. Powers retired from Occidental Petroleum Corporation in January 2017 after more than 30 years of service at Occidental. Prior to her retirement, Ms. Powers served since 2009 as Executive Vice President of Worldwide Exploration for Occidental Oil and Gas Corporation and as Vice President of parent Occidental Petroleum Corporation. From 2006 to 2009, Ms. Powers served as Vice President of Worldwide Exploration. Prior to 2006, Ms. Powers served as Director of Worldwide Geoscience, Vice President of Exploration in Colombia and Chief Exploration Geologist for Worldwide Exploration. Ms. Powers serves as a director of EQT Corporation. Ms. Powers holds a Bachelor of Science degree in Geology with high honors from Texas A&M University.

Skills and Qualifications

Ms. Powers brings over 36 years of experience in the oil and gas industry to CRC’s Board. Her expertise as a senior geoscientist working in hydrocarbon provinces around the world and, in particular, her knowledge of California’s geology greatly benefits CRC’s Board. The Board also benefits from her perspective gained from many years of executive management in the industry.

CALIFORNIA RESOURCES CORPORATION 12

|

Board of Directors and Corporate Governance

|

|

|

• Member of the Audit Committee

• Member of the Compensation Committee

The Board of Directors appointed Ms. Siegel as a director effective as of August 21, 2018. Ms. Siegel is the President of LAS Advisory Services, a firm providing advice to organizations on issues related to talent management, succession planning, organizational capability and culture. From 2003 to 2012, Ms. Siegel served as Senior Vice President of Human Resources and Internal Communications of Tyco International Ltd., a diversified manufacturing and service company. Ms. Siegel had responsibility for rebuilding the leadership team, executing a strategy to restore the confidence of the company's employees and building an HR function with deep expertise in global human resource practices. From 1994 to 2002, she held various positions with Honeywell International Inc., including Vice President of Human Resources — Specialty Materials and was a principal at Strategic Compensation Associates. Ms. Siegel is currently Program Chair of the G100 Talent Consortium. Ms. Siegel is a director and compensation committee chair of the board of directors of CenturyLink, Inc., a broadband, telecommunications and data hosting company, and FactSet Research Systems Inc., a multinational financial data and software company. She is also a director of private company Scoop Technologies. From 2015 to 2019, she served as a director and compensation committee chair of Volt Information Sciences, a provider of global infrastructure solutions in technology, information services and staffing acquisition. Ms. Siegel has an MBA and a Master’s degree in City and Regional Planning, both from Harvard University, and a Bachelor’s degree from the University of Michigan.

Skills and Qualifications

Ms. Siegel brings to our Board substantial experience as a human resources executive with large global

enterprises as well as substantial public company board experience. Her background provides the

Board with unique insight into various issues including talent management, succession planning, executive compensation and culture.

|

|

|

• Chairman of the Nominating and Governance Committee

Mr. Sinnott was appointed to the Board of Directors of CRC in 2014. Mr. Sinnott is Co-Chairman of Kayne Anderson Capital Advisors, L.P., an investment management firm. From 2010 until 2016, he served there as President, Chief Executive Officer and Chief Investment Officer. He also served as a Managing Director there

CALIFORNIA RESOURCES CORPORATION 13

|

Board of Directors and Corporate Governance

from 1992 to 1996 and as its Senior Managing Director from 1996 until assuming the role of Chief Executive Officer in 2010. He is also President of Kayne Anderson Investment Management, Inc., the general partner of Kayne Anderson Capital Advisors, L.P. Mr. Sinnott served as a director of Kayne Anderson Energy Development Company from 2006 through 2013. He was Vice President and Senior Securities Officer of the Investment Banking Division of Citibank from 1986 to 1992 and previously held positions with United Energy Resources, a pipeline company, and Bank of America in its oil and gas finance department. Since 1998, Mr. Sinnott has served on the board of PAA GP Holdings LLC and its predecessor entities and currently serves as chairman of its compensation committee. Mr. Sinnott received a Bachelor of Arts degree from the University of Virginia and a Masters of Business Administration from Harvard University.

Skills and Qualifications

As the Co-Chairman of a California-based investment company investing in energy and other areas, Mr. Sinnott brings extensive insight into the oil and gas and financial industries to the CRC Board of Directors. His experience analyzing industry players and managing a multi-billion dollar investment enterprise allows him to provide insight on a broad variety of matters affecting the oil and gas industry generally and the company specifically. He brings deep understanding of and insight into strategic alternatives, industry trends, deal structures and finance.

|

|

|

Mr. Stevens was appointed President, Chief Executive Officer and a Director of CRC in 2014. Mr. Stevens served as Vice President—Corporate Development of Occidental from 2012 to 2014, as Vice President—California Operations, Oxy Oil & Gas from 2008 to 2012, and as Vice President—Acquisitions and Corporate Finance of Occidental from 2004 to 2012. He also serves on the board of directors of the Western States Petroleum Association. Mr. Stevens holds a Master of Business Administration degree from the University of Southern California and a Bachelor of Science degree from the United States Military Academy.

Skills and Qualifications

Our Board of Directors benefits from Mr. Stevens’ deep knowledge of the oil and gas industry and his expertise in strategically evaluating and valuing oil and gas assets that is derived from years of buying and integrating exploration and production assets, many of which we currently own. Mr. Stevens also brings specific insight into the Company’s operations from his significant managerial experience as an executive at Occidental, including his strong experience in allocating capitalthen current goals and managing Occidental’s and our assets. Mr. Stevens’ extensive experience dealing with California’s regulatory environment, agencies and political landscape and his ability to forge strong ties withinensured the state have proven a valuable asset to the Company.

CALIFORNIA RESOURCES CORPORATION 14

|

Board of Directors and Corporate Governance

Board Refreshment and Evaluation

Identifying and Evaluating Nominees for Directors

Our Nominating and Governance Committee is responsible for leading the search for individuals qualified to serve as directors and for recommending to the Board nominees as directors to be presented for election at meetings of the stockholders or of the Board of Directors. Our Nominating and Governance Committee evaluates candidates for nomination to the Board of Directors, including those recommended by stockholders, and conducts appropriate inquiries into the backgrounds and qualifications of possible candidates. The Nominating and Governance Committee may retain outside consultants to assist in identifying director candidates in its sole discretion, but it did not engage any outside consultants in connection with selecting the nominees for election at the Annual Meeting.

Director Criteria, Qualifications and Experience

Our Corporate Governance Guidelines contain qualifications that apply to director nominees recommended by our Nominating and Governance Committee. In the event that a vacancy on the Board of Directors arises, the Nominating and Governance Committee will consider and review the candidate’s following qualifications, relevant skills, qualifications and experience:

independence under applicable standards;

business judgment;

service on boards of directors of other companies;

personal and professional integrity, including commitment to the Company’s core values;

willingness to commit the required time to serve as a Board of Directors member;

familiarity with the Company and its industry; and

such other matters as the committee deems appropriate.

The Board recognizes the value of having directors from a wide variety of backgrounds who bring diverse opinions, perspectives, skills, experiences, backgrounds and orientations to its discussions and its decision-making processes. A diverse board enables a more balanced, wide-ranging discussion in the boardroom, and is also important to the Company’s stockholders, its management and employees. For these reasons, the Nominating and Governance Committee also will consider the diversity of, and the optimal enhancement of the current mix of talent and experience on, the Board of Directors. For its last vacancy, the Board of Directors appointed Ms. Siegel as a director, which further diversified the board.

Board Evaluations and Incumbent Directors

Our Board believes that a robust annual evaluation process is an important part of its governance practices. For this reason, the Nominating and Governance Committee oversees an annual evaluation of the performance of the Board. The committee distributes written evaluation surveys to each director, and the Chairman of the Board discusses the results of these written surveys with the individual directors. In addition, the Chairman shares the results of the surveys and interviews with the full Board for consideration with respect to director nominees, and Board and committee structure, composition and effectiveness.

CALIFORNIA RESOURCES CORPORATION 15

|

Board of Directors and Corporate Governance

With respect to the reelection of an existing director, the Nominating and Governance Committee will consider the results of the evaluation process and review the director’s:

past Board and committee meeting attendance and performance;

length of Board service;

personal and professional integrity, including commitment to the Company’s core values;

relevant experience, skills, qualifications and contributions that the existing director brings to the Board;

independence under applicable standards; and

such other matters as the committee deems appropriate.

The Board of Directors engages in various activities to obtain additional insight into our business and industry, beneficial perspectives on the performance of the Company, the Board and our management, and on the Company’s strategic direction. From time to time, the full Board receives presentations from its committees, and internal and external advisors, regarding current topics of interest. The Company also makes resources available to individual directors, including access to director education from third party providers.

Director Independence Determinations

Majority independent directors 20% non-independent 80% independent

The Board of Directors has reviewed all direct or indirect business relationships of which it is aware between each director (including his or her immediate family) and us, including those relationships described under “Related Party Transactions” below, as well as each director’s relationships with charitable organizations, to assess director independence as defined in the listing standards of the NYSE. Based on this evaluation, the Board of Directors has determined that Messrs. Albrecht, Gannon, Korell, McMahon, Moncrief, Poladian and Sinnott and Mses. Powers and Siegel are independent directors as that term is defined in the listing standards of the NYSE. Mr. Stevens, the President and Chief Executive Officer, is not considered by the Board of Directors to be an independent director because of his current employment with CRC.

CALIFORNIA RESOURCES CORPORATION 16

|

Board of Directors and Corporate Governance

Board Leadership Structure and Committees